Trent Ltd., once a market darling that topped India's Nifty 50 index in 2024, is stuck in a deepening rout that's wiped out $20 billion in market capitalisation since then.

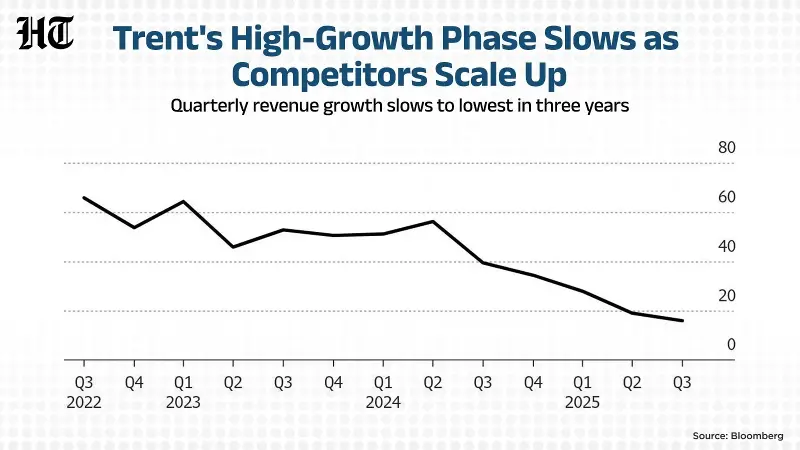

Shares of the Tata Group company fell nearly 40% in 2025—the first annual decline in more than a decade—and dropped another 9% on Tuesday following a disappointing third-quarter performance update. The company has guided for flattish growth in a festive quarter—sales are slowing from an increasing number of storefronts amid intense rivalry in affordable fashion.

The Mumbai-based company—which operates Westside and Zudio—is facing mounting pressure from Reliance Industries Ltd. and Aditya Birla Group which are expanding aggressively into affordable fashion. Urban demand is patchy, eroding investor confidence in a stock once priced at premium valuations.

“It is a challenging time,” Karan Taurani of Elara Securities India Pvt. told Bloomberg News. The retailer, which also operates Star Bazaar grocery chain and Inditex’s Zara and Massimo Dutti stores in India, has to “reinvent their product” to stay ahead of peers, he said.

The ‘Zudio’ rally

Trent’s post-pandemic boom was powered by Zudio, which converted aspirational buyers into loyal shoppers with trendy styles priced as low as ₹399. But as growth cooled, the retailer began diversifying in 2025, launching youth-focused label Burnt Toast, expanding Zudio Beauty, and pushing into categories such as footwear, personal care and innerwear—segments that contributed 21% of sales in the July-September quarter. Westside has also moved into lab-grown diamonds to attract older, premium buyers.

Returns from these initiatives may take months to materialise, Taurani said.

Still, hopes are high that the Zudio moves will revive growth. Abhijeet Kundu, an analyst at Antique Stock Broking, expects more Westside stores to come up in the next few quarters, and sees Trent continuing to outperform peers led by its store experience and expansion strategy.

Rampant expansion, limited returns

Trent added 65 stores across Westside and Zudio in the December quarter, but revenue per square foot fell 16% from a year earlier.

That has Citigroup “cautious” on Trent, according to its Mumbai-based analyst Ashish Kanodia, who cited factors like “increasing competition, the impact of cannibalisation, and new-store expansion” in smaller towns continuing to weigh on the stock.

On Wednesday, Trent shares rose 0.30% to ₹4,059.80 apiece on the BSE even as the benchmark Sensex ended the day 0.12% lower at 84,961.14 points.