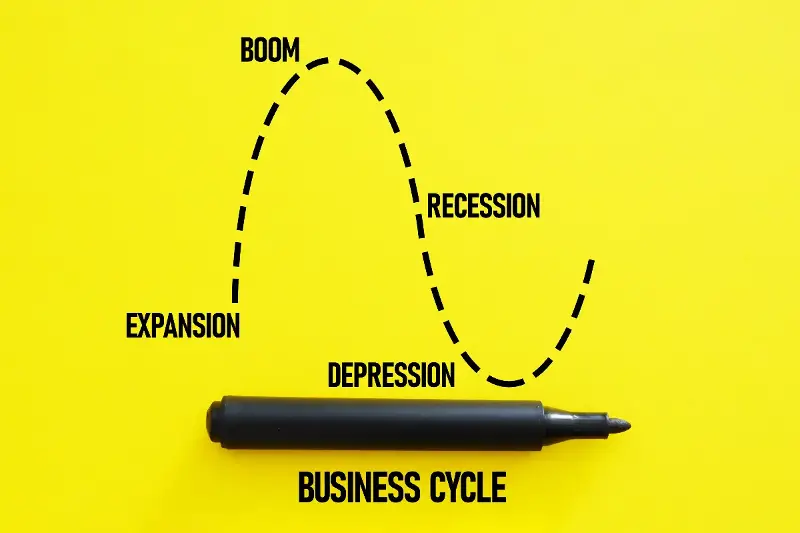

The rhythm of economies is rarely still. Across continents and centuries, businesses and households alike have felt the pulse of the business cycle—a dramatic sequence of boom, recession, and recovery that repeats with persistent regularity. But how does this hidden conductor influence our world, and why does its pattern matter so much for everyday life?

The Unseen Engine: What Drives the Business Cycle?

Underneath the bustle of city centres and the calm of rural markets, invisible forces constantly shape economic activity. The business cycle, at its core, is the pattern of expansion and contraction seen in economic growth over time. This cycle is driven by a blend of factors, including shifts in consumer confidence, technological innovations, policy decisions, and global events.

- During a boom, optimism reigns. Consumers spend freely, companies hire en masse, and stock markets soar. Imagine the roar of new car sales, the sparkle of glitzy shopping districts, or the surge in property prices.

- When a recession strikes, the mood darkens. Job losses rise, spending tightens, and bankruptcies may increase. The contrast is stark—empty storefronts, cautious consumers, nervous investors.

- In a recovery, hope returns. Businesses adapt or reinvent, government stimulus spurs demand, and people gradually regain the confidence to spend and invest.

Each phase interacts with the rest like the changing seasons—inevitable, impactful, and often surprising in transition. Policies like interest rates, taxes, and public spending play a dramatic role in shaping the amplitude and duration of each cycle.

Boom Times: Champagne or Caution?

While booms seem like economic “good times”, they’re not all glitz and glamour. Periods of rapid expansion can inspire dazzling innovation and wealth creation, driving:

- Lower unemployment—companies need more hands on deck.

- Rising consumer spending—people indulge in the finer things.

- New business formation—entrepreneurs see opportunities everywhere.

But unchecked booms can sow the seeds of their own downfall—think property bubbles or runaway credit. Too much euphoria often sets the stage for painful corrections down the road.

A vivid case: The late 1990s dotcom boom. Venture capital flowed fast, fuelling start-ups with sky-high valuations. Yet when reality bit, countless firms vanished almost overnight, erasing billions in wealth but also preparing the ground for today’s tech giants.

Recession: The Shadow That Shapes Resilience

Recession is a word that worries everyone, and for good reason—these are times that test resolve and creativity. Yet, history shows recessions are rarely the end of the story.

What typically happens?

- Slower growth or outright contraction in GDP.

- Joblessness climbs, and some businesses fold.

- Asset values—like property or shares—drop sharply.

However, recessions also force adaptation and spark reinvention. Many of today’s household brands and robust business models were born from past downturns, learning vital lessons about efficiency, agility, and consumer needs. It’s during recessions that governments and businesses are often compelled to innovate.

The Art of Recovery: How Economies Bounce Back

After the clouds, the sunlight returns. Recovery phases showcase the resilience of people and organisations, often revealing an economy’s true strength. Watch for:

- Gradual improvement in labour markets.

- Renewal of investment into infrastructure and innovation.

- Policy interventions, such as lower interest rates and stimulus spending.

Some sectors—like technology or green energy—may leap ahead, reshaping societies and laying a fresh foundation for future booms. Others, such as retail or hospitality, rebuild step by cautious step, learning from past excesses.

Global Ripples: Why the Business Cycle Matters Beyond Borders

Ours is a connected world. The business cycle in one major economy can spark a chain reaction. When America sneezes, Europe often catches a cold. Global supply chains, capital flows, and trade agreements mean no country is truly immune.

Fascinatingly:

- A boom in China’s manufacturing can lift commodity exporters in Africa.

- A recession in Europe can depress tourism across Asia and the Middle East.

- Rapid recovery in technology benefits start-ups from Nairobi to New York.

Understanding the global ripple effect is essential for businesses, investors, and governments navigating the stormy seas of international commerce.

The business cycle, far from being mere theory, underpins the rhythm of modern life. It is both warning and opportunity, challenge and invitation.

What phase are we in now, and how will it shape the next chapter of our collective economic story? Each twist in the business cycle invites us to ask not just what’s happening, but how we as consumers, entrepreneurs, and citizens can better harness its energy for the world of tomorrow.