Investors often focus on profit numbers while analysing stocks. Quarterly net profit growth, margins and earnings surprises dominate headlines. But history shows that profits alone do not sustain companies alive. Cash does.

Many companies collapse despite showing profits on paper. Others survive decades with modest margins because they consistently generate cash. The difference lies in the cash flow statement, not the income statement.

Today, investors can track operating cash flow, free cash flow and long-term cash trends for every listed company on Finology Ticker, where annual cash flow data and balance sheets are presented in a standard, comparable format.

Profit vs cash flow: the hidden gap investors miss

Accounting profits are based on accruals. Revenue is recorded when earned, not when cash is received. Expenses are booked when incurred, not when paid.

This gap can create a dangerous illusion.

A company may show:

- ₹10 crore net profit

- ₹40 crore stuck in receivables

- ₹30 crore locked in inventory

- ₹20 crore debt repayment due

Despite profits, actual cash available may be less than ₹5 crore.

This is why 82% of business failures globally are linked to cash flow stress, not losses. Tracking only profit ignores the timing mismatch between earnings and cash.

On Ticker, investors can compare net profit vs operating cash flow over multiple years, helping identify whether profits are converting into real money.

Understanding cash flow: what actually matters

The cash flow statement has three parts, but not all are equally important.

Operating cash flow (OCF)

- Cash generated from core business operations

- Reflects collections from customers minus payments to suppliers and employees

- Most critical metric for stock analysis

Investing cash flow (ICF)

- Cash spent on capex, acquisitions or asset sales

- Negative ICF is fine if it leads to growth

Financing cash flow (FCF)

- Cash from borrowing, equity issuance, dividends and buybacks

- Consistently positive financing cash flow for survival is a red flag

Golden rule: Over time, operating cash flow should exceed net profit.

This comparison is easily visible on Finology Ticker’s cash flow and ratios section for each company.

Case studies from Indian markets: cash flow separates winners from laggards

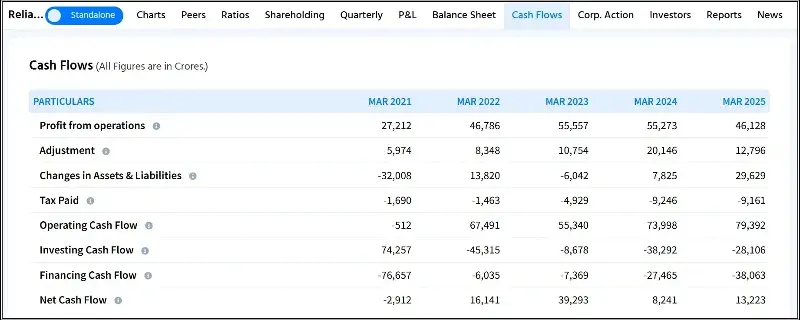

Reliance Industries: scale backed by cash generation

Reliance Industries is a prime example of how modest margins can still create massive shareholder value through cash flow.

FY25 highlights:

- Revenue above ₹5.2 lakh crore

- Operating cash flow: ₹79,392 crore

- Capex: ₹28,106 crore

- Free cash flow: ₹51,286 crore

Key reasons for strong cash flow:

- Refining and petrochemicals generate upfront cash

- Retail operates largely on cash sales

- The telecom business reached scale, improving collections

Despite operating margins of only 8-10%, Reliance generates ₹50,000+ crore in annual free cash flow, which funds capex, debt reduction, and new businesses.

On Ticker, this transition from a high-investment phase to steady deleveraging is evident in long-term cash flow and debt trends.

Lesson: Cash generation, not margin size, funds long-term growth.

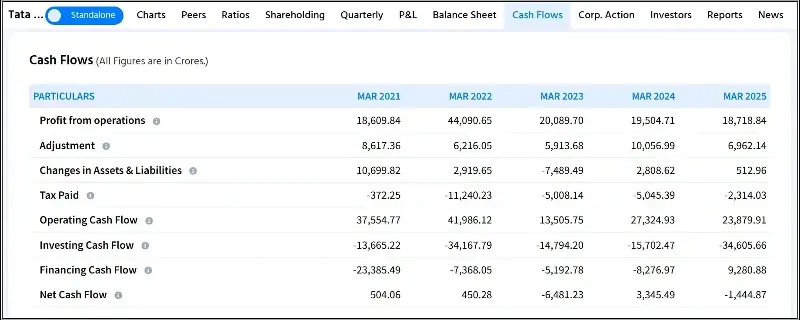

Tata Steel: when working capital eats cash

Tata Steel highlights how capital-intensive businesses can struggle with cash flow even when EBITDA looks healthy.

FY25 working capital metrics:

- Inventory days: 171

- Receivable days: 9

- Payable days: 113

- Cash conversion cycle: 67 days

This means cash remains locked in inventory for extended periods.

Financial impact:

- Operating cash flow improved year-on-year

- Free cash flow rose to ₹93,391 crore

- Net debt remained elevated at ₹81,886 crore

High inventory in a cyclical commodity business increases vulnerability during downturns. Even profitable years may not materially reduce debt.

Tracking inventory, cash conversion cycle and net debt together on Ticker helps investors understand this risk early.

Lesson: High EBITDA does not guarantee strong cash flow in cyclical sectors.

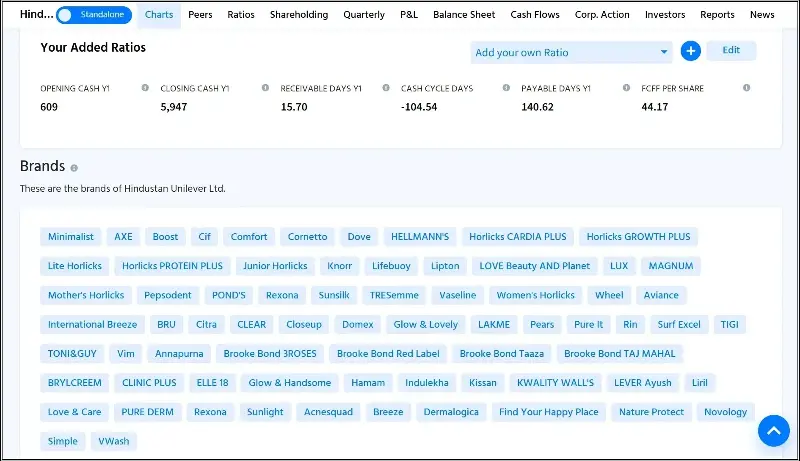

Hindustan Unilever: the cash conversion benchmark

HUL is considered one of India’s best cash-generating businesses.

FY25 performance:

- Net profit: ₹12,024 crore

- Operating cash flow: ₹11,886 crore

- OCF to profit ratio: 98.9%

- Free cash flow: ~ ₹10,000 crore

Working capital strength:

- Inventory days: 35-40

- Receivable days: 22-28

- Payable days: 150-160

- Cash conversion cycle: negative ~70 days

A negative CCC indicates that HUL collects cash before paying suppliers.

This enables:

- High dividend payouts

- Minimal debt

- Strong balance sheet resilience

Ticker’s multi-year cash flow comparison shows how HUL consistently converts profits into cash.

Lesson: Businesses with pricing power and fast inventory cycles dominate long-term returns.

Key cash flow metrics investors must track

Operating cash flow growth

- Should grow with revenue over time

OCF to net profit ratio

- Above 100% over multi-year periods signals high earnings quality

Free cash flow

- Cash left after capex

- Funds dividends, buybacks and debt reduction

Cash conversion cycle

- Faster cycles reduce funding risk

- Negative CCC is a major advantage

Free cash flow yield

- FCF divided by market cap

- Above 5% often signals undervaluation

All these metrics are available on Finology Ticker without manual calculations.

Screening stocks using cash flow filters

Cash flow-based screening reduces risk significantly.

Effective filters include:

- Operating cash flow CAGR above 15%

- OCF consistently greater than net profit

- Debt-to-equity below 0.5

- Stable or improving cash conversion cycle

In the image below, you can get the query to filter stocks using cash flow filters. Finology Ticker Stock Screener can help you get results in seconds and it is free to use.

Red flags investors should not ignore

Common warning signs:

- Rising profits but falling operating cash flow

- Persistent negative free cash flow

- Financing cash flow funding operations

- Worsening cash conversion cycle

- One-time cash inflows masking weak core cash

Most long-term wealth destroyers show these signs well before stock prices collapse.

Final takeaway

Profits attract attention. Cash flow determines survival.

Companies that consistently convert earnings into cash withstand cycles, reduce debt and reward shareholders. Those that depend on external funding eventually struggle.

With structured access to cash flow statements, ratios, and long-term trends on Finology Ticker, investors now have the data they need. The advantage comes from using it consistently.

In the long run, stock prices follow cash, not accounting profits.

Finology is a SEBI-registered investment advisor firm with registration number: INA000012218.

Disclaimer: The views and recommendations made above are those of individual analysts or broking companies, and not of Mint. We advise investors to check with certified experts before making any investment decisions.