InCred has released its latest outlook on the Indian economy and equity markets, identifying a mixed macroeconomic environment while spotlighting high-conviction stock ideas. The firm observed that while rainfall and kharif sowing trends remain favourable, weak industrial data and slowing loan growth suggest near-term headwinds. InCred has added NTPC to its conviction list, while removing Petronet LNG, Birla Corporation, and Ultratech Cement due to sectoral challenges.

Mixed Macro Trends Shape Market Outlook

InCred said India received above-normal southwest monsoon rainfall in June 2025, with precipitation coming in 8.9 percent above the long-period average (LPA). The early monsoon coverage supported a strong 11 percent year-on-year rise in kharif sowing, boosting near-term agricultural sentiment. However, industrial activity painted a different picture.

InCred noted that India’s industrial production slowed to a nine-month low of 1.2 percent in May 2025, primarily due to weakness in manufacturing, mining, and electricity. The consumer non-durables segment contracted for the fourth consecutive month. Meanwhile, loan growth moderated to 9.5 percent year-on-year, with large corporate and consumer durable loans seeing the sharpest contraction. New investment proposals also fell sharply quarter-on-quarter, highlighting caution in capital deployment.

High-Conviction Stock Picks: Additions and Deletions

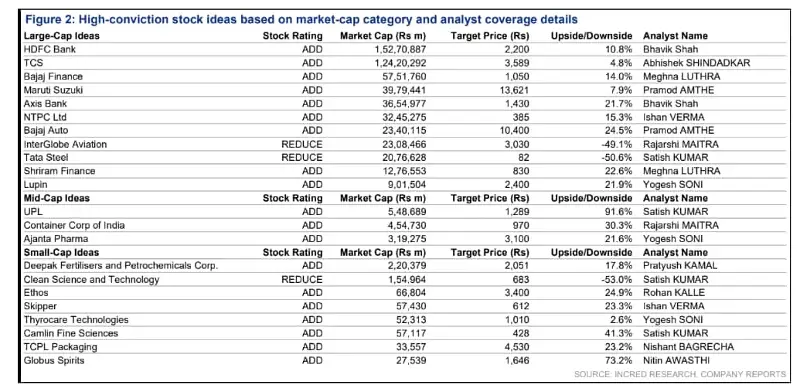

Among equity ideas, InCred added NTPC to its high-conviction list. InCred said NTPC’s planned capacity addition of 11.8 GW in FY26 could drive an 8 percent CAGR in its regulated equity base through FY27. The company’s diversification into renewables (60 GW target by FY32), nuclear energy (2.8 GW), and green hydrogen (5 GW by FY30) significantly boosts its long-term growth prospects. InCred continues to prefer large-cap stocks amid macro uncertainty.

On the other hand, InCred removed Petronet LNG from its stock list, citing concerns over LNG volume growth. The brokerage said spot price rigidity and delays in the Kochi-Bengaluru pipeline commissioning may limit volume ramp-up and delay utilisation at the Kochi terminal in FY26.

InCred also removed Birla Corporation and Ultratech Cement from its preferred list. The brokerage pointed to a seasonally weak period for both cement demand and pricing across India. In addition, higher fixed costs from plant maintenance in the monsoon season are likely to hurt margins in the near term.

High Conviction Picks

Recent Performance Snapshot

InCred’s conviction list launched in September 2022 has yielded a mixed performance. InCred said Camlin Fine Sciences and Thyrocare Technologies have outperformed the Nifty since the inception of the series. However, Tata Consultancy Services and Bajaj Auto have underperformed the broader index over the same period, prompting a reassessment of their near-term upside potential.

Technically Strong Picks: UPL and Deepak FertilisersIn its latest technical analysis, InCred highlighted favourable chart setups in UPL and Deepak Fertilisers and Petrochemicals Corporation. The brokerage said both counters exhibit bullish momentum, suggesting scope for short-term outperformance. These stocks are recommended under the ‘ADD’ rating, indicating a positive bias with scope for further gains.

InCred’s latest strategy note reflects a balanced outlook on the Indian economy, combining cautious macroeconomic assessments with a focus on stock-specific fundamentals and technical indicators. While the firm remains wary of sectors facing structural or seasonal headwinds, it continues to find value in large-cap plays like NTPC and technically sound names such as UPL and Deepak Fertilisers. As macro trends evolve, InCred's selective approach aims to identify resilient opportunities across segments.

Disclaimer: The views and recommendations made above are those of individual analysts or broking companies, and not of Mint. We advise investors to check with certified experts before making any investment decisions.