Vietnam's coffee exports are set to set a new record in 2025. The top 10 export markets continue to play a leading role, driving growth for the entire industry.

Export turnover reached a new record - $8.92 billion.

2025 marks a significant turning point for Vietnam's coffee industry, with exports not only increasing in volume but also experiencing a strong surge in value, clearly reflecting the changing global market and the increasingly solid position of Vietnamese coffee in the global supply chain.

According to a report from the Import-Export Department ( Ministry of Industry and Trade ), citing data from the Vietnam Customs Department, Vietnam exported 1.59 million tons of coffee in 2025, an increase of 18.3% compared to 2024, while the export value reached over US$8.92 billion, a significant increase of 58.8%. This increase in value, more than three times the rate of increase in volume, indicates that the average export price of coffee has risen sharply, becoming the main driving force behind the increase in export value.

In December 2025 alone, exports reached nearly 183,000 tons, worth approximately $948 million, concluding an impressive year for Vietnam's coffee industry.

Europe continues to play a pivotal role.

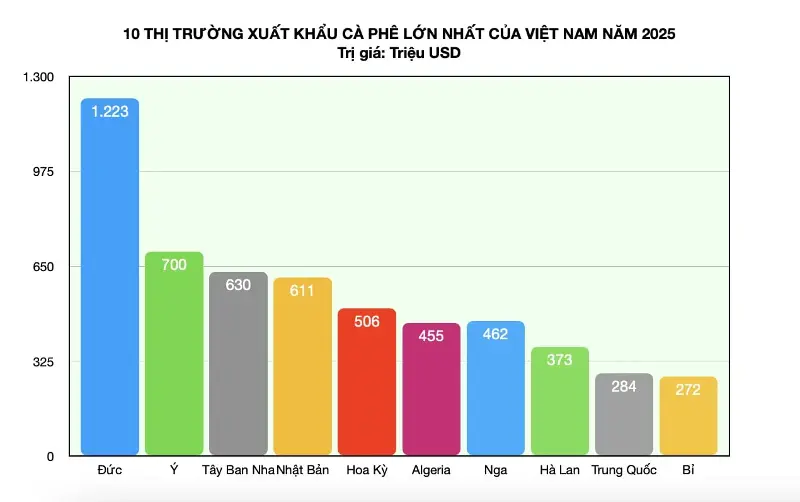

Among the top 10 largest markets, Europe remains the most important pillar for Vietnamese coffee. Germany continues to lead with 231,000 tons, worth nearly $1.23 billion, an increase of almost 49% in volume and over 103% in value. Not only is it a major consumer market, but Germany is also a roasting and re-export hub for the EU region, demonstrating that Vietnamese coffee has been and continues to play a crucial role in the European coffee supply chain.

Vietnam's coffee exports in 2025 are projected to reach 1.59 million tons, valued at US$8.9 billion, representing an 18.3% increase in volume and a 58.8% increase in value compared to 2024. Photo: NNMT .

Italy and Spain continued to maintain their positions in the top group with export values reaching $700 million and nearly $630 million respectively. Notably, although the increase in production was only around 9-11%, the export value increased by over 40-50%, reflecting the market trend of prioritizing value over quantity. The Netherlands and Belgium also recorded high increases in value, at 57.9% and 72.5% respectively.

The growth trend in Europe shows that Vietnamese coffee is increasingly meeting the stringent requirements for quality, traceability, and sustainability standards in this market.

The United States and Japan: Two different color palettes.

Among non-European markets, the United States was the most prominent, with export value reaching $506.7 million, a 56.9% increase compared to 2024. Notably, exports to the United States in December increased sharply compared to the previous month, indicating strong import demand for the year-end and New Year consumption seasons. This is also a positive sign for Vietnamese coffee in a market with high demands for quality and traceability.

Meanwhile, Japan continues to demonstrate the characteristics of a stable and sustainable market. Export volume increased by only 5.1%, but value still rose by 46.6%, reflecting stable demand and the ability to accept higher prices for quality coffee.

Unexpected highlights

One of the most notable highlights is Algeria, where Vietnam's coffee exports increased by 161.5% in volume and 257.1% in value – the highest increase among the top 10. This shows that Vietnamese coffee is expanding strongly in the North African region, where consumer demand is growing rapidly and there are fewer stringent technical barriers compared to the EU.

Graphics: Hong Tham / Data: Vietnam Customs Department.

Although not yet a large market in terms of size, China continues to maintain its growth momentum, with export value increasing by 22.5%. Given the rapidly developing coffee consumption culture in China, it is considered a market with great potential in the medium and long term, especially for processed and instant coffee.

Coffee exports to Russia reached $462.3 million, a 50.9% increase in value. Despite the impact of geopolitical and payment factors, Russia remains a stable market for Robusta coffee – Vietnam's main export product – contributing to the diversification of export markets.

Assessment and outlook

The picture of the top 10 coffee export markets in 2025 shows a strong shift in growth trends from "quantity" to "value". Europe remains the mainstay, but emerging markets such as North Africa and China are opening up new growth opportunities. With coffee prices remaining high, this presents an opportunity for the Vietnamese coffee industry to accelerate deep processing, build brands, and achieve sustainable development, gradually enhancing its position in the global coffee value chain.

In 2026, Vietnam's coffee exports are projected to remain strong thanks to stable global demand and diversified supply policies from importing markets. However, the market also faces numerous challenges as weather risks, production cost pressures, and increasingly stringent requirements for quality standards, sustainable development, and traceability continue to grow.

To maintain growth momentum and improve export efficiency, the coffee industry needs to focus on improving quality, promoting deep processing, and developing high value-added products to enhance competitiveness in the international market.